Double declining balance method formula

The formula for depreciation under the double-declining method is as follows. The formula for double-declining balance is a relatively simple one.

Double Declining Balance Method Of Deprecitiation Formula Examples

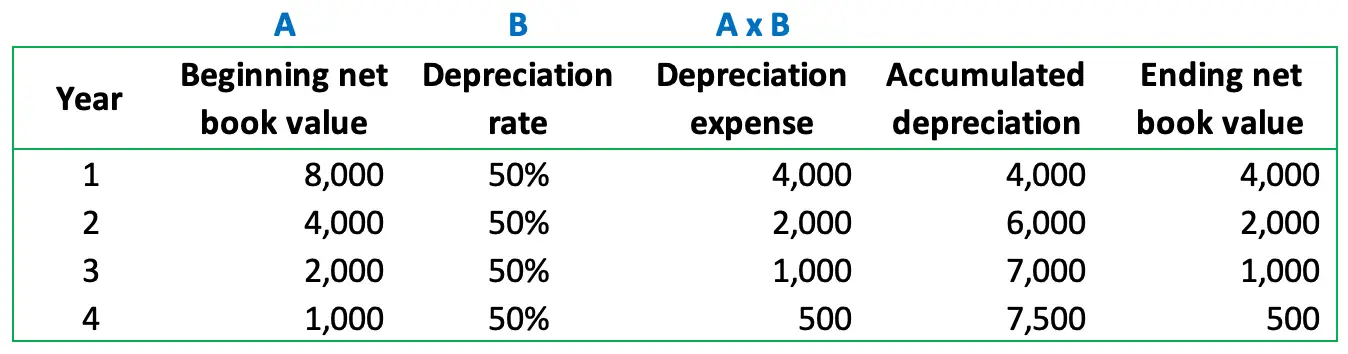

The Double Declining method calculates depreciation by multiplying the asset book value at the beginning of the fiscal year by basic depreciation rate and 2.

. They can use the following double-declining balance method formula to calculate the depreciation charge. The double-declining balance formula is a method used in business accounting to determine an accelerated depreciation of a long-term asset. Though the DDB depreciation method may seem complicated at first the formula for calculating the rate is actually very simple.

Essentially the DDB depreciation rate will be. What is the formula for calculating the double-declining balance. Also discussed in the first.

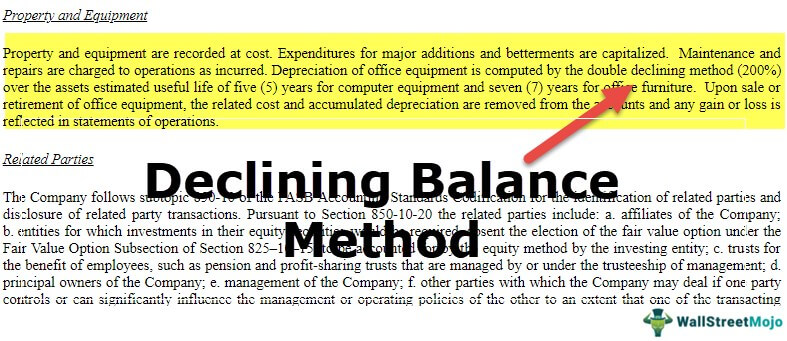

This method depreciates an asset. The double declining balance depreciation method shifts a companys tax liability to later years. The most common is called the double-declining balance which is an accelerated depreciation model.

Depreciation Opening book value of the fixed asset x Straight-line depreciation. Double Declining Balance Method formula 2 Book Value of Asset at Beginning SLM. The double declining balance formula.

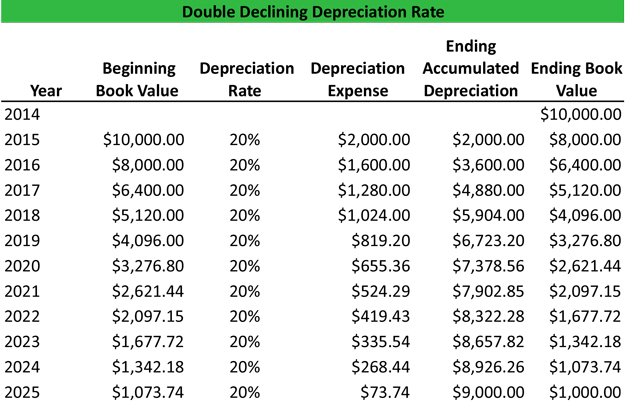

Depreciation 2 Straight-line depreciation percent. To consistently calculate the DDB depreciation balance you need to only follow a few steps. 2 Cost of the Asset Depreciation Rate.

The Double Declining Balance Depreciation Method Formula. The double-declining balance method also called the 200 declining balance method is a common method for calculating accumulated depreciation or the value an asset. Companies use this formula to recalculate the annual depreciation.

The double declining balance method is simply a declining balance method in which double 200 of the straight line depreciation rate is used. Companies use this formula. Double declining balance rate 2 x 20 40.

Because youre subtracting a different amount every year you cant simply. The double declining balance rate 2 x straight line depreciation rate. The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset.

Calculating a double declining balance is not complex although it requires some considerations. When using the double-declining balance method be sure to use the following formula to make your calculations. Now that you have all of the information you can follow the formula for double declining balance depreciation.

There are two versions of the double declining balance method. DDB 2 x straight-line depreciation percent x book value DDB. The double declining balance is.

The book value of the. The formula for double-declining balance is a relatively simple one. The double-declining balance method depreciates the freezer by 600 2 x 01 x 3000 during the first year so that its book value is 2400 3000 600 at the start of the next.

When using the double. Straight line depreciation rate 15 02 or 20.

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Depreciation Formula Examples With Excel Template

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

How To Use The Excel Ddb Function Exceljet

Double Declining Balance Method Of Depreciation Accounting Corner

Declining Balance Depreciation Double Entry Bookkeeping

What Is The Double Declining Balance Method Definition Meaning Example

Double Declining Balance Method Prepnuggets

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

Double Declining Balance Depreciation Calculator

Double Declining Balance Depreciation Daily Business

Simple Tutorial Double Declining Balance Method Youtube

What Is The Double Declining Balance Ddb Method Of Depreciation

Calculate Double Declining Balance Depreciation Accountinginside

Double Declining Balance Depreciation Method Youtube

Double Declining Depreciation Efinancemanagement